Fund Update — Q3 2022

Previous quarterly update:

Fund Update Q2 2022

Q3 2022 Venture Investments

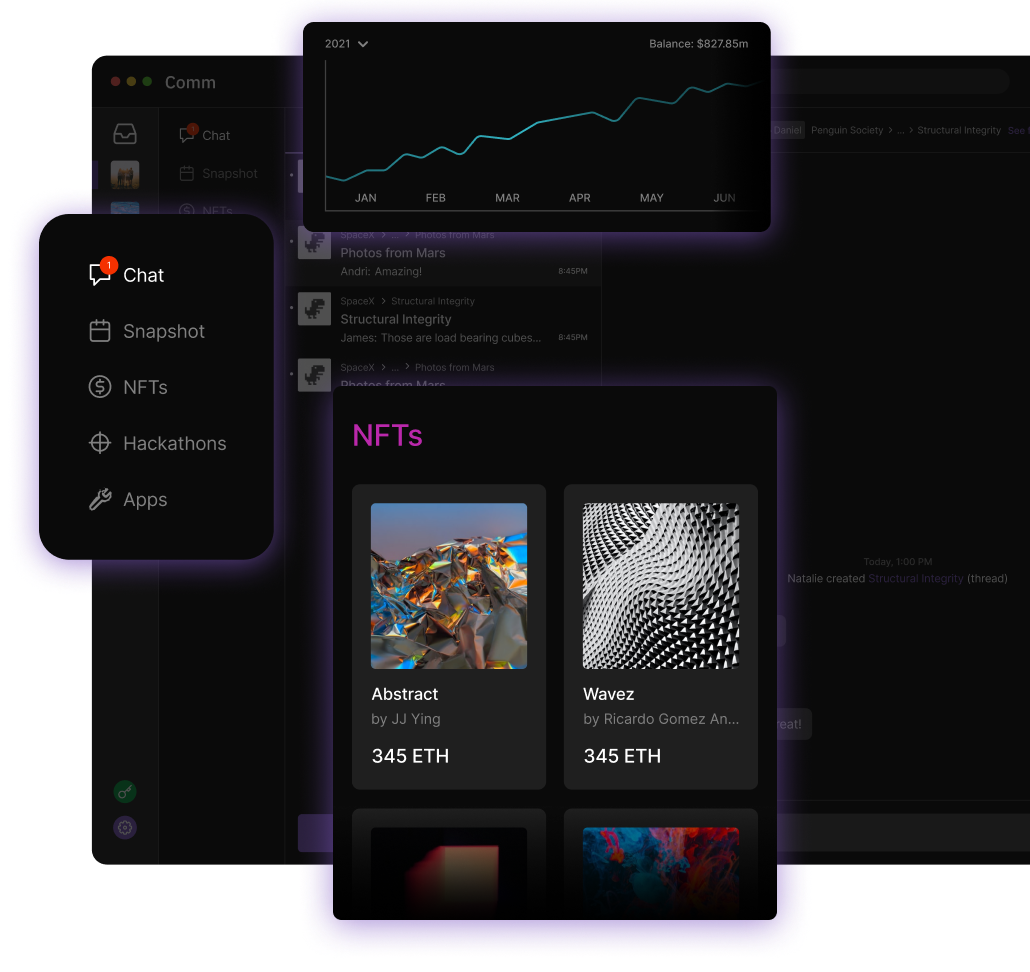

Comm (Seed, New)

Comm is bringing federated keyserver architecture to encrypted communications apps with a focus on serving crypto-native teams. Right now, the crypto space is heavily reliant on Discord and Telegram, which are not web3-native and have centralized servers. The concept of onchain identity is also not native. Comm will focus on UX for asynchronous communications that are timely and relevant for individual user filters, while keyservers will eventually incentivize users to have their own servers, which will be the home to their digital identity.

Comm is developing a top notch front-end application, with some of the best React developers we've seen–and will eventually serve as encryption infrastructure for the communication layer of web3.

Follow their Twitter here for updates!

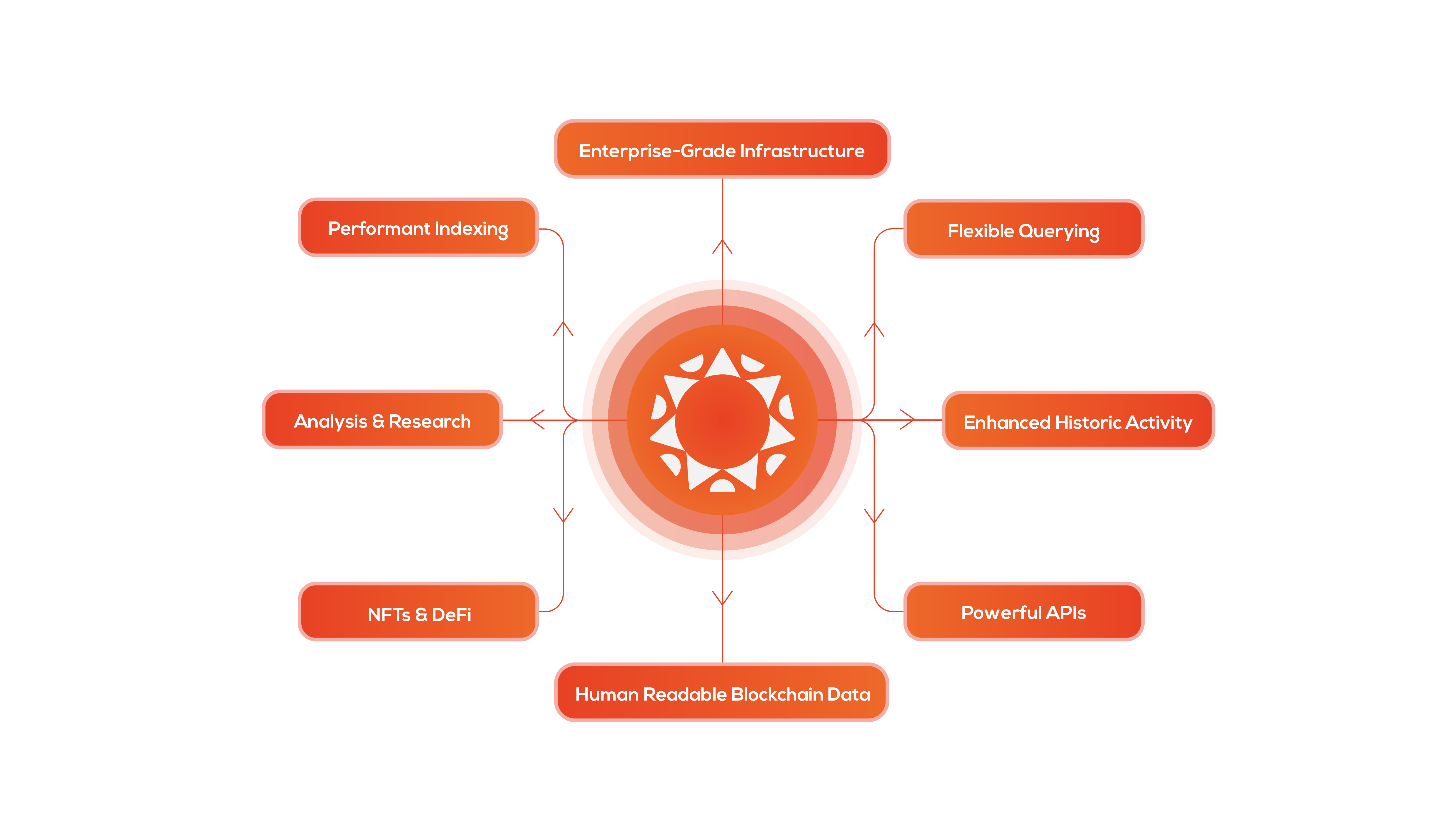

Helius (Seed, New)

We were blown away by the team at Helius and their relentless focus on building, shipping products, and pleasing customers. We may write a separate thesis on why we're so bullish on Helius–but one of the main things that attracted us was their deep specialization. It's popular in crypto to talk about being multichain with endless connectivity to all chains, but deep specialization in one chain, in this case Solana, is underrated. Understanding the nuances of a layer 1's architecture and mastering its tool set and SDKs, along with aligning with the "culture" of the chain makes a big difference in terms of go-to-market. Helius is focused on making blockchain data readable and digestible for everyone, along with things like RPC products, APIs and webhooks. Building apps on Helius will become a staple and they already have a huge waitlist and strong initial customer base.

Helius is open to building on other chains down the road, but right now they are 100% focused on Solana and have built A+ credibility. Mert, the founder of Helius, is probably a top 3 developer in the Solana space, with co-founders that are ex-AWS/Amazon infrastructure and data engineers that understand things like app reliability, parsing, and indexing.

Follow their Twitter here for updates!

Venture and Macro Outlook

We believe we are getting somewhat closer to a market bottom, but we are still being patient and strategic with deploying too much capital at once. Macro continues to be a concern with stickier-than-expected inflation, energy issues, and foreign policy concerns. As we discussed in the last update, inflation coming down to the Fed's target of 2% will take time. Many people overshot expectations on inflation rushing back down to <5% and began to get overly bullish in Q3. There are all kinds of signals still showing demand has not cooled off to the extent it needs to, but that will likely change soon. Market valuations will continue taking time to recalibrate and realign in conjunction with this macro transition. We see no point in diving back quickly into the market, as a sideways phase is likely to follow an eventual bottoming, which we hope to see happen in the next ~3-6 months.

Venture deal flow continues to lessen, but we have seen plenty of high-signal opportunities and will likely continue doing 2 to 4 deals per quarter. Valuations have now generally come down to reasonable levels (e.g. ~$10-14M Seed). We are still seeing certain funds flood the market with excess capital they raised at the top and at excessive valuations that only make sense for a lead investor filling the majority of the round with higher than average sizing. We are default avoiding these deals. Outside of a few outliers, we believe high seed valuations and raising too much capital before any traction does a number to a Founder's psychology – and growth expectations become untenable. We will see many projects that raised at these absurd, feel-good (in the moment) valuations fail. Luckily, even in the bull market, we held off on falling into these traps and remained grounded. Only in the bear market are many investors now starting to realize this.

Crypto Update and Outlook

Throughout our last updates, we discussed how the actual 'Merge' event would be at best anti-climactic and more likely a "sell the news" event. We were correct on this prediction and have continued to hold the vast majority of our cash position, with some new, relatively small purchases in Bitcoin around $19,000 recently. We still don't believe this is the final bottom, but as mentioned prior, believe it's important to begin accumulating even if another ~30-40% drop is in the cards. For now, our focus is on strengthening our BTC position and playing other allocations by ear. Outside of potential random swing trades, small cap tokens will not be considered until the market is looking far healthier, and where we can play into bigger narrative and sector shifts. Right now, things just seem sporadic with zero structure and we don't see a point wasting time there.

Broadly, we see one of two scenarios playing out over the next 6 months or so:

1) A final washout and harsh leg down to ~$12,000 BTC levels (perhaps in correlation with ~3200 S&P levels) with alts fully capitulating in parallel. This will be followed by sideways action for longer than anyone wishes, with likely bounces, hope, despair, and re-tests along the way. Eventual strength into 2024 and beyond.

2) A few quarters of boring sideways action from here, with signs of stronger accumulation moving into next year. Still lots of despair, but with a big flavor of denial if things improve. No further big leg down, only re-tests of previous lows and perhaps a smaller wick down to ~$15,000 or so. Eventual strength into 2024 and beyond.

We put scenario #1 at a higher probability than #2, but are preparing for both, which is why some level of accumulation has begun now. It's also possible this takes longer to play out, but our focus this year has actually been more heavily in venture bets and early token deals while mostly temporarily turning our shoulders to the liquid markets as they wind-down and correct. But we are now shifting way more attention into assessing liquid markets, as we see prime opportunities on the horizon. You can also see that in both scenarios we believe things should begin to improve by 2024 regardless, but it could still be a longer grind up than expected after that. Regardless, we believe we are very well positioned for either scenario, along with many venture/early crypto investments showing promise, even through the bear market.

Survival, liquidity, patience, and conviction are the most important things over the next year. For all our bearishness over the last ~10 months, we believe the crypto industry will come out of this stronger than ever, even if things look grueling and will likely continue to shake up bulls for a while. Let the naysayers celebrate a bit longer before eating their words yet again.

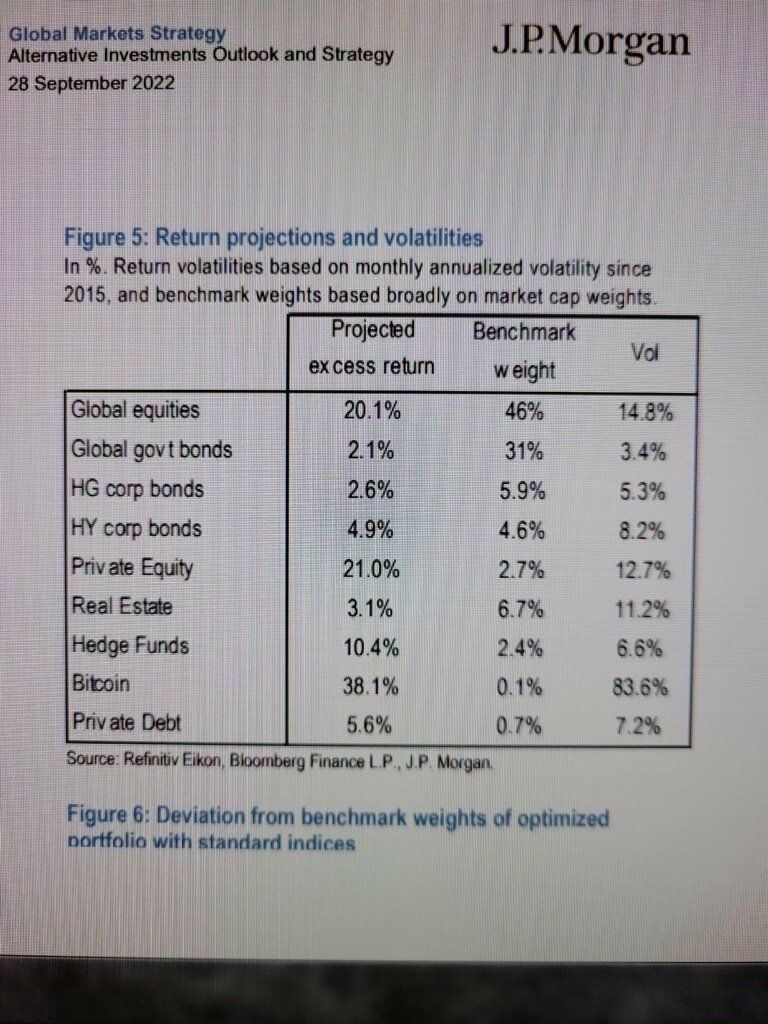

We will leave readers with this. As seen above (pardon the resolution), Bitcoin is likely to be the fastest horse off lows according to JPM (and other similar analysis we've seen). Generational buying opportunities are coming.

This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Visary Capital or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.