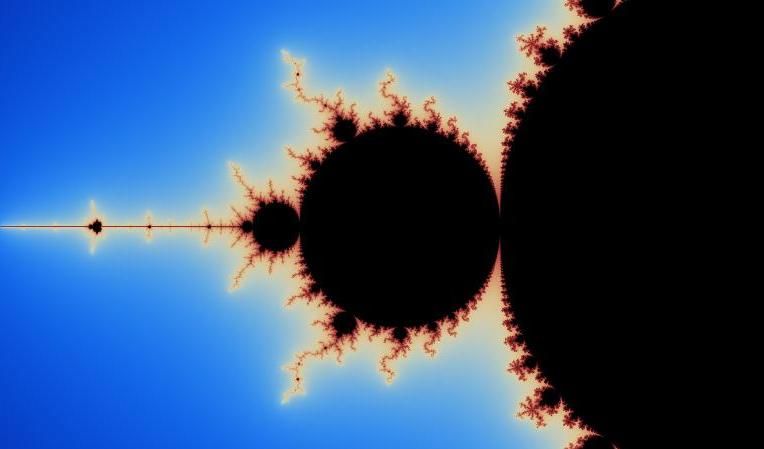

Mandelbrot Markets

Bitcoin recently breached previous levels of $6,000 and dropped to a new ~$3,500 low on 11/25/2018. As of writing this, Bitcoin is back above $4,000 and could find some temporary support before another definitive move in either direction.

It feels like we are in the 9th inning of selling. In its usual fractal fashion, it seems this market needed any reason to get to the historical ~80–90% correction levels we’ve seen in past cycles to begin finding a psychological bottom zone. Bitcoin has now reached about an 82.5% drop from previous all-time highs. For reference, the 2014 bottom was met with an 86.7% correction. When reached, it will likely be followed by a flattened accumulation period for a while. We have been buyers since Bitcoin hit $5,000. Timing the bottom will be nearly impossible, so we setup various buy zones between 3 and 5 thousand.

Perspective and zooming out are always important. Here’s an article from the 2011 crash back when prices were in the teens and twenties.

Here’s a compiled list of “Bitcoin obituaries” where journalists, academics, and pundits have claimed Bitcoin’s demise more than 325 times and counting over the last decade. It’s important to remember that Bitcoin is still the world’s best performing asset over the last 10 years.

We treat Bitcoin as a generational 'venture' bet and remain bullish on the overall crypto space over the next 5-10 years and beyond to power infrastructure and rails for new financial systems. Liquidity is of the utmost importance in crypto and we plan to always continue managing liquid books and being active participants in the living, breathing crypto market. This is what sets us apart from most venture funds entering the space who haven't a clue about liquidity management. With that said, we plan to grow the venture fund year over year to a certain point (~33% of AUM) because we can bring unique value there and love working with founders. We’ve been fortunate enough to be on the frontlines with some exceptional teams who will begin to release, distribute, and launch their products over the next few years. The best teams are in it for the long haul and realize bear markets are the best time for building. This bear market will act as a great leveler to not only cleanse the bad actors and short term players, but for new technology, development, and real world adoption to become the primary focus. There will undoubtedly be more hype cycles, manias, and peaks and troughs in this wider multi-decade long trend – particularly during a broad era of 'easy money' monetary policy and populism (although that trend itself will have its own ebbs and flows in between).

From a financial services perspective, we’re seeing a lot of infrastructure products with go-live dates put in place for 2019 such as Nasdaq, Fidelity, and NYSE’s Bakkt implementing Bitcoin futures. Wall Street’s interest in this space has not wavered despite recent price drops, as they have acknowledged that digital assets and cryptocurrencies are here to stay. The framework for wider adoption will take time, but it is coming.

With that said, this “crypto winter” could easily last 12-18 more months before Bitcoin’s price gets back to $10,000+ levels. Hope has to be restored after the blow-off top, and aftershocks in the market take time to heal, as does trust and psychology. Even when price bottoms out, it will likely go sideways for quite some time. Even when these institutional products are launched, money flows and demand won’t come immediately. And even when this happens, overall sentiment will take time to repair and reset. Better regulatory frameworks and guidance are also required in areas – but it must be done right.

Fred Wilson of Union Square Ventures sums up our similar thoughts on the long game here: What Bear Markets Look Like. The dot-com crash got rid of the hype (e.g. Pets.com) and allowed real value to come to the surface. Just a few years after that bubble burst, Google started to dominate search and Facebook started to dominate social media. The flavor-of-the-month, short term companies riding the hype had collapsed, opening the market up and grounding it in reality. Since then and aside from core "big tech" companies, we see tons of consumer, SaaS, and enterprise technology companies with tremendous growth and cash flows (and of course, still plenty of unprofitable/unsustainable ones – but that's what a market is!) Over time, we will see something similar happen in this space. There is no doubt that gimmicks and scams will still exist and we may have not seen the worst in that area yet – but each cycle will have its own lessons and evolve over time. Great companies will emerge from creative destruction.

As Fred Wilson points out, all the people now calling for Ethereum’s death is likely a contrarian signal that it’s close to the bottom. As of writing this, Ether is around $115. We've been early investors in Ether shortly after its launch and have invested in other projects building in the space. We are still buyers today because we only see developer participation, conviction, and community participation increasing. If Ether has a leg down below $100, we plan to load up more substantially.

We still believe this asset class represents the best asymmetrical risk and low time preference investments that anyone can make right now. The underlying sociopolitical theme of populism is upon us, where individuals are seeking change in the financial system through better transparency and decentralization. Many of the teams we’re invested in are committed to making this change a reality – and we will be here through thick and thin.

This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Visary Capital or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.