Managing the Cycle: Crypto Fund Update – Q1 2021

The first quarter of 2021 was action-packed for the crypto markets, as Bitcoin hit new highs every month, finally topping at the last local high of ~$61,500 in March. The fund saw major growth across the portfolio which was more pronounced in DeFi and a number of longer term crypto venture investments that rallied.

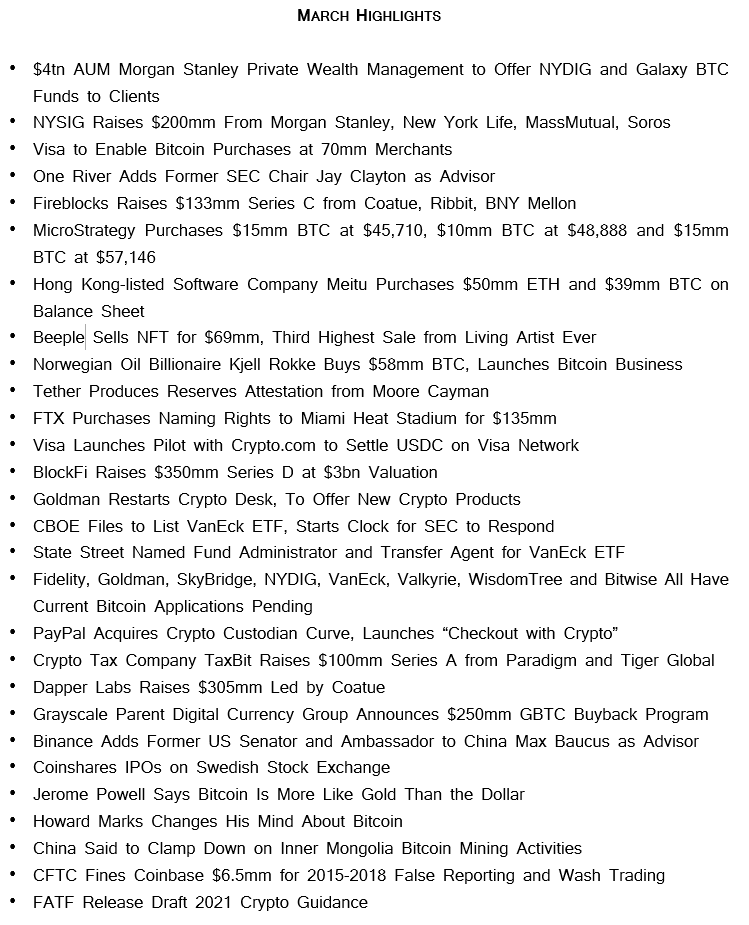

Bitcoin saw more institutional interest, including a major purchase from Tesla for their balance sheet. Other large financial institutions like Morgan Stanley began offering Bitcoin to their wealth management customers. The cycle of mass adoption from retail usage to deep institutional integration is real. The news was so dense in the quarter we can't even begin to cover it all here, but here is an overview of March highlights (thanks to Travis Kling).

There was certainly an increased level of euphoria in the market, especially as the hype of NFTs hit the mainstream and a plethora of celebrities posted rather cringe-inducing things about crypto. But it's all part of the broader, viral adoption curve, so we're ok with it. Ironically, until we stop obsessing over "top signals," we don't believe the top is actually in. It will likely happen when everyone is too distracted to think about top signals.

We believe there is still room for growth in this cycle and expect to see more announcements from big industry players, funds, and even governments acquiring Bitcoin positions. We also think the long awaited Bitcoin ETF may have a chance at being approved in the US this year. These catalysts will help drive the next leg up to $100,000+, along with the macro environment of central banks injecting trillions into economies around the world and expanding money supplies to unprecedented levels. We would be far more surprised if things substantially cooled off from here or went into a corrective phase but we did downsize a few alt positions when things became too euphoric.

Below we'll cover some specific areas where we saw remarkable growth.

In the beginning of Q1, we saw many DeFi projects across the space go parabolic. Our Q4 2020 investments into Sushi and BadgerDAO ended up as some of our best performers. We continue to hold and stake both.

Our investment in SKALE Network, a project we bet on in its infancy in 2018, is now up over ~70X as of writing this. We continue to stake for ~1-2% yield per month and are long term supporters of the team and community, as scaling solutions become crucial for Ethereum.

Filecoin rallied and broke top 10 crypto by market cap due to increased mining and storage output, which is currently at 3.83 exbibyte (or 260 bytes). For frame of reference, that is enough storage to store ~17,235 Wikipedias on the decentralized web. Institutional activity in Filecoin was also a major reason for the boost, seeing large inflows from Grayscale and others. It is now one of our best performers, as the censorship-resistant web becomes a more relevant narrative.

Stacks continues building and performing well, especially after launching their 2.0 "stacking" update and now having over $400M in value locked and earning Bitcoin rewards. We expect to see more traction with new apps and adoption for Stacks, along with the possibility of more liquidity opening up via bigger exchanges.

Another strategic investment from 2018, Origin Protocol, built out new NFT auctions for their marketplace product. They broke the record with artist 3LAU for a single NFT auction at $11,684,101, which caused Origin's token to rally to new highs. They also launched the exclusive NFT auction for Lupe Fiasco's new album. The Origin team has been heads down building since the bear market and continues to adapt. We're excited to see what's next.

We also wanted to give a shout-out to Yearn for their new and much improved UI/UX and recent TVL explosion. We are early investors in the project from last summer and believe they are still among the best teams in DeFi. Despite sideways action and under-performance for the prior few months (after unprecedented growth last year) we believe a new groove will be found soon, as developers are more incentivized to build than ever due to treasury changes. We agree with Delphi's analysis to not sleep on Yearn just yet. A nice addition has been the release of the YFI lending vault for ~30% APY.

New additions in January 2021 included Mirror Protocol (MIR) and one of our old school favorites, 0x Protocol (ZRX), both of which we thought were undervalued at the time and still are. They have both performed well since being allocated. As the fund grows, one of the most important aspects of adding new positions is ensuring they have enough liquidity and depth. At this point in the cycle, we will likely be more conservative in adding net new positions and instead focus on rotations back into BTC, ETH or USDC/fiat.

Over the next ~3-6 months, properly managing and reading the cycle will be the focus in terms of rotating or downsizing positions. We believe there is still more upside in Q2 and Q3 but beyond that timeframe, things will likely start to feel heavier.

In general, this fund has been more focused on 1-5 year strategic investments, along with continually upsizing our virtually long-only positions into Bitcoin and Ethereum as cores. That strategy has paid off in a big way. We don't plan to begin active trading to a large degree but we will remain opportunistic in maximizing returns and mindful of fundamental market changes.

We recently wrote our Q1 2021 update for the Venture Fund, which you can read here.

Lastly, we are also excited to share our analysis on the hot-button issue of Bitcoin's energy consumption here.

This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Visary Capital or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.